Trump Media’s $2.5B Bitcoin Bet Sparks Momentum in the Crypto Market

Trump Media’s bold $2.5 billion investment in Bitcoin is driving renewed momentum in the broader crypto market.

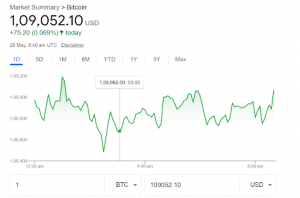

CA, UNITED STATES, May 29, 2025 /EINPresswire.com/ -- Bitcoin’s recent price surge, topping $109,000 and flirting with the $110,000 mark, has once again thrust the cryptocurrency into the mainstream spotlight. But it’s not just market dynamics driving the buzz; political and corporate backing is playing a major role. In a headline-making move, Trump Media & Technology Group has announced plans to raise $2.5 billion, specifically to invest in Bitcoin, signaling unprecedented institutional confidence in the digital asset.

The investment, to be split between $1.5 billion in stock sales and $1 billion in convertible notes, marks a bold entry into the crypto space from a company closely tied to former U.S. President Donald Trump. The funds will bolster Trump Media’s Bitcoin treasury holdings and support the development of crypto-focused financial products, including ETFs, further legitimizing BTC’s role in global finance.

This announcement follows Bitcoin’s return to a $2 trillion market cap and builds on previous corporate moves like DigiAsia’s Bitcoin treasury allocation.

Market Statistics & Expert Quotes

https://twitter.com/TRTWorldNow/status/1927637562505462065

Bitcoin has surged to a record high, driven by a wave of corporate investments, notably the $2.5 billion Bitcoin treasury initiative by Trump Media & Technology Group (TMTG). This move, involving the sale of $1.5 billion in stock and $1 billion in convertible notes, positions TMTG among the largest public holders of Bitcoin, signaling significant institutional confidence in the cryptocurrency.

Analysts suggest that such substantial corporate investments are fueling Bitcoin's bullish momentum. LMAX analyst Joel Kruger predicts that favorable fundamentals could propel Bitcoin's price to $145,000, citing institutional interest and strategic investments like TMTG's as key drivers.

Why Bitcoin Price Momentum Matters to Everyday Users?

As institutional money flows into Bitcoin, most recently through Trump Media’s multibillion-dollar move, the perception of the asset has shifted from speculative gamble to serious store of value.

But this institutional confidence doesn’t just influence the portfolios of hedge funds and public companies; it also opens new avenues for individuals to engage with and benefit from Bitcoin’s rise.

Regulatory Landscape

The regulatory landscape of Bitcoin remains fragmented and dynamic. In the U.S., Bitcoin is treated as property by the IRS and a commodity by the CFTC, while the SEC continues to evaluate its role in securities markets. Globally, countries like El Salvador embrace it as legal tender, while others, including China, maintain strict bans.

The upcoming U.S. GENIUS Act aims to regulate stablecoins, indirectly influencing Bitcoin's ecosystem. Overall, increased institutional interest is prompting more governments to clarify crypto regulations, balancing innovation with investor protection and anti-money laundering efforts. Regulatory clarity is expected to play a major role in Bitcoin’s future trajectory.

Where to Buy Crypto For Investing?

With Bitcoin trading near $109K and institutional giants like Trump Media making multibillion-dollar bets on BTC, retail investors are eager to join the rally. If you’re looking to invest in Bitcoin, acquiring it securely and efficiently is your first step.

Centralized exchanges (CEXs) like Coinbase, Binance, Kraken, and Gemini remain the most popular platforms for buying crypto. These exchanges provide fiat on-ramps, allowing you to purchase BTC or stablecoins like USDT using a debit card, credit card, or bank transfer. Their regulatory compliance and beginner-friendly interfaces make them ideal for newcomers navigating this high-stakes market.

Once you’ve bought your crypto, transfer it to a non-custodial wallet to retain full control of your assets. For Bitcoin-only users, BlueWallet and Electrum are trusted choices. For multi-asset support, wallets like TrustWallet, Exodus, or MetaMask (for Ethereum-based tokens) offer broader functionality.

Blue Ribbon Group

Kade Ventures Pvt. Ltd.

email us here

Distribution channels: Banking, Finance & Investment Industry, Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release