LexinFintech Holdings Ltd. Reports First Quarter 2025 Unaudited Financial Results

/EIN News/ -- SHENZHEN, China, May 21, 2025 (GLOBE NEWSWIRE) -- LexinFintech Holdings Ltd. (“Lexin” or the “Company”) (NASDAQ: LX), a leading technology-empowered personal financial service enabler in China, today announced its unaudited financial results for the quarter ended March 31, 2025.

Mr. Jay Wenjie Xiao, Chairman and Chief Executive Officer of Lexin, commented, “The continued improvement across key performance indicators marks the success of our transformation towards a business model driven by data analytics, risk management, and refined operations.

In the first quarter, key risk metrics continued to trend strongly, validating the effectiveness of our risk management revamp initiatives. Thanks to the ongoing improvements in risk performance, net income for the first quarter exceeded RMB430 million, sustaining its strong growth trajectory and returning to the highest level for the past 13 quarters.

Looking ahead, we will focus on prioritizing customer-centric approaches, elevating customer experience and boosting the competitiveness of our offers, strengthening the business synergies across our ecosystem, and driving technological innovation—particularly in the application of AI. Through operational excellence and strategic agility, we aim to build long-term resilience and competitiveness in a dynamic environment.

Despite the challenging macroeconomic environment, evolving industry landscape, and geopolitical uncertainties, the management remains confident in achieving a significant year-over-year growth in net income, reaffirming our full-year net income guidance.

The management has consistently attached great importance to delivering value to shareholders through various approaches. In November 2024, the board raised the cash dividend payout ratio from 20% to 25% of total net income. We are pleased to announce that the board of directors has approved to further increase the cash dividend payout ratio from 25% to 30% of total net income, effective from the second half of 2025.”

Mr. James Zheng, Chief Financial Officer of Lexin, commented, “Our first-quarter financial results mark another key milestone in our net income target. In the quarter, net income exceeded RMB430 million, representing a 19% quarter-over-quarter and 113% year-over-year increase. Net profit take rate was 1.58%, calculated as net income divided by average loan balance, advancing by 27 basis points compared to the previous quarter. The strong net income growth was underpinned by sustained improvements in asset quality, alongside a further reduction in funding costs.

Looking ahead, we’re committed to a prudent operating strategy, ecosystem synergy enhancement and operational refinement. For the full year 2025, we expect our net income to deliver strong year-over-year growth.”

First Quarter 2025 Operational Highlights:

User Base

- Total number of registered users reached 232 million as of March 31, 2025, representing an increase of 8.1% from 215 million as of March 31, 2024, and users with credit lines reached 46.2 million as of March 31, 2025, up by 7.8% from 42.8 million as of March 31, 2024.

- Number of active users1 who used our loan products in the first quarter of 2025 was 4.8 million, representing an increase of 6.0% from 4.5 million in the first quarter of 2024.

- Number of cumulative borrowers with successful drawdown was 34.5 million as of March 31, 2025, an increase of 7.6% from 32.0 million as of March 31, 2024.

Loan Facilitation Business

- As of March 31, 2025, we cumulatively originated RMB1,376.7 billion in loans, an increase of 17.6% from RMB1,171.1 billion as of March 31, 2024.

- Total loan originations2 in the first quarter of 2025 was RMB51.6 billion, a decrease of 11.0% from RMB58.0 billion in the first quarter of 2024.

- Total outstanding principal balance of loans3 reached RMB107 billion as of March 31, 2025, representing a decrease of 11.7% from RMB122 billion as of March 31, 2024.

Credit Performance4

- 90 day+ delinquency ratio was 3.3% as of March 31, 2025, as compared with 3.6% as of December 31, 2024.

- First payment default rate (30 day+) for new loan originations was below 1% as of March 31, 2025.

Tech-empowerment Service

- For the first quarter of 2025, we served over 95 business customers with our tech-empowerment service.

- In the first quarter of 2025, the business customer retention rate5 of our tech-empowerment service was over 80%.

Installment E-commerce Platform Service

- GMV6 in the first quarter of 2025 for our installment e-commerce platform service was RMB1,126 million, representing an increase of 24.7% from RMB903 million in the first quarter of 2024.

- In the first quarter of 2025, our installment e-commerce platform service served over 310,000 users and 200 merchants.

Other Operational Highlights

- The weighted average tenor of loans originated on our platform in the first quarter of 2025 was approximately 13.4 months, as compared with 12.5 months in the first quarter of 2024.

- Repeated borrowers’ contribution7 of loans across our platform for the first quarter of 2025 was 86.1%.

First Quarter 2025 Financial Highlights:

- Total operating revenue was RMB3,104 million, representing a decrease of 4.3% from the first quarter of 2024.

- Credit facilitation service income was RMB2,191 million, representing a decrease of 17.3% from the first quarter of 2024. Tech-empowerment service income was RMB625 million, representing an increase of 72.8% from the first quarter of 2024. Installment e-commerce platform service income was RMB288 million, representing an increase of 24.4% from the first quarter of 2024.

- Net income attributable to ordinary shareholders of the Company was RMB430 million, representing an increase of over 100% from the first quarter of 2024. Net income per ADS attributable to ordinary shareholders of the Company was RMB2.39 on a fully diluted basis.

- Adjusted net income attributable to ordinary shareholders of the Company8 was RMB472 million, representing an increase of over 100% from the first quarter of 2024. Adjusted net income per ADS attributable to ordinary shareholders of the Company8 was RMB2.62 on a fully diluted basis.

__________________________

- Active users refer to, for a specified period, users who made at least one transaction during that period through our platform or through our third-party partners’ platforms using the credit line granted by us.

- Total loan originations refer to the total principal amount of loans facilitated and originated during the given period.

- Total outstanding principal balance of loans refers to the total amount of principal outstanding for loans facilitated and originated at the end of each period, excluding loans delinquent for more than 180 days.

- Loans under Intelligent Credit Platform are excluded from the calculation of credit performance. Intelligent Credit Platform (ICP) is an intelligent platform on our “Fenqile” app, under which we match borrowers and financial institutions through big data and cloud computing technology. For loans facilitated through ICP, the Company does not bear principal risk.

- Customer retention rate refers to the number of financial institution customers and partners who repurchase our service in the current quarter as a percentage of the total number of financial institution customers and partners in the preceding quarter.

- GMV refers to the total value of transactions completed for products purchased on our e-commerce and Maiya channel, net of returns.

- Repeated borrowers’ contribution for a given period refers to the principal amount of loans borrowed during that period by borrowers who had previously made at least one successful drawdown as a percentage of the total loan facilitation and origination volume through our platform during that period.

- Adjusted net income attributable to ordinary shareholders of the Company, adjusted net income per ordinary share and per ADS attributable to ordinary shareholders of the Company are non-GAAP financial measures. For more information on non-GAAP financial measures, please see the section of “Use of Non-GAAP Financial Measures Statement” and the tables captioned “Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

First Quarter 2025 Financial Results:

Operating revenue was RMB3,104 million in the first quarter of 2025, as compared to RMB3,242 million in the first quarter of 2024.

Credit facilitation service income was RMB2,191 million in the first quarter of 2025, as compared to RMB2,648 million in the first quarter of 2024. The decrease was due to the decrease in guarantee income and loan facilitation and servicing fees-credit oriented, partially offset by the increases in financing income.

Loan facilitation and servicing fees-credit oriented was RMB1,136 million in the first quarter of 2025, as compared to RMB1,417 million in the first quarter of 2024. The decrease was primarily due to the decrease in the origination of off-balance sheet loans.

Guarantee income was RMB548 million in the first quarter of 2025, as compared to RMB744 million in the first quarter of 2024. The decrease was primarily due to the decrease of outstanding balances in the off-balance sheet loans funded by certain institutional funding partners, which are accounted for under ASC 460, Guarantees.

Financing income was RMB507 million in the first quarter of 2025, as compared to RMB487 million in the first quarter of 2024. The increase was primarily driven by the increase in the average outstanding balance of the on-balance-sheet loans.

Tech-empowerment service income was RMB625 million in the first quarter of 2025, as compared to RMB362 million in the first quarter of 2024. The increase was primarily driven by the increase of loan facilitation volume through ICP and the increase of referral services.

Installment e-commerce platform service income was RMB288 million in the first quarter of 2025, as compared to RMB232 million in the first quarter of 2024. The increase was primarily driven by the increase in transaction volume in the first quarter of 2025.

Cost of sales consisted of cost of inventory sold and other costs. Cost of sales was RMB262 million in the first quarter of 2025, as compared to RMB236 million in the first quarter of 2024, which was consistent with the increase in installment e-commerce platform service income.

Funding cost was RMB83.0 million in the first quarter of 2025, as compared to RMB90.7 million in the first quarter of 2024. The decrease was primarily driven by the decrease in the funding rates to fund the on-balance sheet loans.

Processing and servicing costs was RMB551 million in the first quarter of 2025, as compared to RMB588 million in the first quarter of 2024. The decrease was primarily driven by a decrease in risk management expenses.

Provision for financing receivables was RMB182 million for the first quarter of 2025, as compared to RMB137 million for the first quarter of 2024. The increase was primarily due to the increase of the outstanding loan balances of on-balance sheet loans and reflects the most recent performance in relation to on-balance sheet loans.

Provision for contract assets and receivables was RMB130 million in the first quarter of 2025, as compared to RMB166 million in the first quarter of 2024. The decrease was primarily driven by the improvement of credit risk performance and the decrease of the outstanding loan balances of off-balance sheet loans.

Provision for contingent guarantee liabilities was RMB677 million in the first quarter of 2025, as compared to RMB828 million in the first quarter of 2024. The decrease was primarily driven by the improvement of credit risk performance and the decrease of outstanding balances in the off-balance sheet loans funded by certain institutional funding partners, which are accounted for under ASC 460, Guarantees.

Gross profit was RMB1,219 million in the first quarter of 2025, as compared to RMB1,197 million in the first quarter of 2024.

Sales and marketing expenses was RMB493 million in the first quarter of 2025, as compared to RMB418 million in the first quarter of 2024. This increase was primarily due to an increase in online advertising costs.

Research and development expenses was RMB156 million in the first quarter of 2025, as compared to RMB135 million in the first quarter of 2024. The increase was primarily due to increased investment in technology development.

General and administrative expenses was RMB101 million in the first quarter of 2025, as compared to RMB89.8 million in the first quarter of 2024. The increase was primarily due to the increase in personnel related costs.

Change in fair value of financial guarantee derivatives and loans at fair value was a gain of RMB74.6 million in the first quarter of 2025, as compared to a loss of RMB316 million in the first quarter of 2024. The change was primarily driven by the fair value gains realized as a result of the release of guarantee obligation as loans are repaid, partially offset by the fair value loss from the re-measurement of the expected loss rates.

Income tax expense was RMB101 million in the first quarter of 2025, as compared to income tax benefit of RMB53.4 million in the first quarter of 2024. The increase was primarily due to the increase in income before income tax expense.

Net income was RMB430 million in the first quarter of 2025, as compared to RMB202 million in the first quarter of 2024.

Recent Development

Updated Dividend Policy

In the third quarter of 2024, the Board of the Company approved to raise the cash dividend payout ratio to 25% of total net income, effective from January 1, 2025. On May 19, 2025, the Board has further approved an updated dividend policy, under which the cash dividend payout will be increased to 30% of total net income, to be paid semi-annually starting from the second half of 2025.

Business Outlook

Looking ahead, while our performance continues to demonstrate positive momentum, we remain prudent in light of ongoing macroeconomic uncertainties. Based on our preliminary assessment, we expect net income for the full year 2025 to achieve a significant year-over-year growth driven by continued improvements in asset quality. The forecast is subject to the impact of macroeconomic factors, and we may adjust the performance outlook as appropriate based on evolving circumstances.

Conference Call

The Company’s management will host an earnings conference call at 10:00 PM U.S. Eastern time on May 21, 2025 (10:00 AM Beijing/Hong Kong time on May 22, 2025).

Participants who wish to join the conference call should register online at:

https://register-conf.media-server.com/register/BI0dc0f8f7695c4583bd50587c8b103490

Once registration is completed, each participant will receive the dial-in number and a unique access PIN for the conference call.

Participants joining the conference call should dial in at least 10 minutes before the scheduled start time.

A live and archived webcast of the conference call will also be available at the Company's investor relations website at http://ir.lexin.com.

About LexinFintech Holdings Ltd.

We are a leading credit technology-empowered personal financial service enabler. Our mission is to use technology and risk management expertise to make financing more accessible for young generation consumers. We strive to achieve this mission by connecting consumers with financial institutions, where we facilitate through a unique model that includes online and offline channels, installment consumption platform, big data and AI driven credit risk management capabilities, as well as smart user and loan management systems. We also empower financial institutions by providing cutting-edge proprietary technology solutions to meet their needs of financial digital transformation.

For more information, please visit http://ir.lexin.com.

To follow us on Twitter, please go to: https://twitter.com/LexinFintech.

Use of Non-GAAP Financial Measures Statement

In evaluating our business, we consider and use adjusted net income attributable to ordinary shareholders of the Company, non-GAAP EBIT, adjusted net income per ordinary share and per ADS attributable to ordinary shareholders of the Company, four non-GAAP measures, as supplemental measures to review and assess our operating performance. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We define adjusted net income attributable to ordinary shareholders of the Company as net income attributable to ordinary shareholders of the Company excluding share-based compensation expenses, interest expense associated with convertible notes, and investment income/(loss) and we define non-GAAP EBIT as net income excluding income tax expense, share-based compensation expenses, interest expense, net, and investment income/(loss).

We present these non-GAAP financial measures because they are used by our management to evaluate our operating performance and formulate business plans. Adjusted net income attributable to ordinary shareholders of the Company enables our management to assess our operating results without considering the impact of share-based compensation expenses, interest expense associated with convertible notes, and investment income/(loss). Non-GAAP EBIT, on the other hand, enables our management to assess our operating results without considering the impact of income tax expense, share-based compensation expenses, interest expense, net, and investment income/(loss). We also believe that the use of these non-GAAP financial measures facilitates investors’ assessment of our operating performance. These non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP.

These non-GAAP financial measures have limitations as an analytical tool. One of the key limitations of using adjusted net income attributable to ordinary shareholders of the Company and non-GAAP EBIT is that they do not reflect all items of income and expense that affect our operations. Share-based compensation expenses, interest expense associated with convertible notes, income tax expense, interest expense, net, and investment income/(loss) have been and may continue to be incurred in our business and are not reflected in the presentation of adjusted net income attributable to ordinary shareholders of the Company and non-GAAP EBIT. Further, these non-GAAP financial measures may differ from the non-GAAP financial information used by other companies, including peer companies, and therefore their comparability may be limited.

We compensate for these limitations by reconciling each of the non-GAAP financial measures to the most directly comparable U.S. GAAP financial measure, which should be considered when evaluating our performance. We encourage you to review our financial information in its entirety and not rely on a single financial measure.

Exchange Rate Information Statement

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.2567 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on March 31, 2025. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about Lexin’s beliefs and expectations, are forward-looking statements. These forward-looking statements can be identified by terminology such as “will,” “ expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Among other things, the expectation of the collection efficiency and delinquency, business outlook and quotations from management in this announcement, contain forward-looking statements. Lexin may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Lexin’s goal and strategies; Lexin’s expansion plans; Lexin’s future business development, financial condition and results of operations; Lexin’s expectation regarding demand for, and market acceptance of, its credit and investment management products; Lexin’s expectations regarding keeping and strengthening its relationship with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborates with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Lexin’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Lexin does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

LexinFintech Holdings Ltd.

IR inquiries:

Will Tan

Tel: +86 (755) 3637-8888 ext. 6258

E-mail: willtan@lexin.com

Media inquiries:

Ruifeng Xu

Tel: +86 (755) 3637-8888 ext. 6993

E-mail: media@lexin.com

SOURCE LexinFintech Holdings Ltd.

| LexinFintech Holdings Ltd. Unaudited Condensed Consolidated Balance Sheets |

|||||||||

| As of | |||||||||

| (In thousands) | December 31, 2024 | March 31, 2025 | |||||||

| RMB | RMB | US$ | |||||||

| ASSETS | |||||||||

| Current Assets | |||||||||

| Cash and cash equivalents | 2,254,213 | 3,173,298 | 437,292 | ||||||

| Restricted cash | 1,638,479 | 1,545,269 | 212,944 | ||||||

| Restricted term deposit and short-term investments | 138,497 | 218,490 | 30,109 | ||||||

| Short-term financing receivables, net(1) | 4,668,715 | 4,743,393 | 653,657 | ||||||

| Short-term contract assets and receivables, net(1) | 5,448,057 | 5,009,319 | 690,303 | ||||||

| Deposits to insurance companies and guarantee companies | 2,355,343 | 2,203,109 | 303,597 | ||||||

| Prepayments and other current assets | 1,321,340 | 1,347,805 | 185,732 | ||||||

| Amounts due from related parties | 61,722 | 77,239 | 10,644 | ||||||

| Inventories, net | 22,345 | 19,341 | 2,665 | ||||||

| Total Current Assets | 17,908,711 | 18,337,263 | 2,526,943 | ||||||

| Non-current Assets | |||||||||

| Restricted cash | 100,860 | 80,464 | 11,088 | ||||||

| Long-term financing receivables, net(1) | 112,427 | 92,087 | 12,690 | ||||||

| Long-term contract assets and receivables, net(1) | 317,402 | 350,993 | 48,368 | ||||||

| Property, equipment and software, net | 613,110 | 636,939 | 87,773 | ||||||

| Land use rights, net | 862,867 | 854,267 | 117,721 | ||||||

| Long-term investments | 284,197 | 244,193 | 33,651 | ||||||

| Deferred tax assets | 1,540,842 | 1,589,522 | 219,042 | ||||||

| Other assets | 500,363 | 433,738 | 59,772 | ||||||

| Total Non-current Assets | 4,332,068 | 4,282,203 | 590,105 | ||||||

| TOTAL ASSETS | 22,240,779 | 22,619,466 | 3,117,048 | ||||||

| LIABILITIES | |||||||||

| Current liabilities | |||||||||

| Accounts payable | 74,443 | 63,294 | 8,722 | ||||||

| Amounts due to related parties | 10,927 | 9,124 | 1,257 | ||||||

| Short-term borrowings and current portion of long-term borrowings | 690,772 | 781,324 | 107,669 | ||||||

| Short-term funding debts | 2,754,454 | 3,207,177 | 441,961 | ||||||

| Deferred guarantee income | 975,102 | 1,158,164 | 159,599 | ||||||

| Contingent guarantee liabilities | 1,079,000 | 769,397 | 106,026 | ||||||

| Accruals and other current liabilities | 4,019,676 | 3,909,239 | 538,708 | ||||||

| Total Current Liabilities | 9,604,374 | 9,897,719 | 1,363,942 | ||||||

| Non-current Liabilities | |||||||||

| Long-term borrowings | 585,024 | 505,408 | 69,647 | ||||||

| Long-term funding debts | 1,197,211 | 891,390 | 122,837 | ||||||

| Deferred tax liabilities | 91,380 | 102,617 | 14,141 | ||||||

| Other long-term liabilities | 22,784 | 14,006 | 1,930 | ||||||

| Total Non-current Liabilities | 1,896,399 | 1,513,421 | 208,555 | ||||||

| TOTAL LIABILITIES | 11,500,773 | 11,411,140 | 1,572,497 | ||||||

| Shareholders’ equity: | |||||||||

| Class A Ordinary Shares | 205 | 205 | 30 | ||||||

| Class B Ordinary Shares | 41 | 41 | 7 | ||||||

| Treasury stock | (328,764 | ) | (305,025 | ) | (42,034 | ) | |||

| Additional paid-in capital | 3,314,866 | 3,331,382 | 459,077 | ||||||

| Statutory reserves | 1,178,309 | 1,178,309 | 162,375 | ||||||

| Accumulated other comprehensive income | (29,559 | ) | (31,818 | ) | (4,385 | ) | |||

| Retained earnings | 6,604,908 | 7,035,232 | 969,481 | ||||||

| Total shareholders’ equity | 10,740,006 | 11,208,326 | 1,544,551 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 22,240,779 | 22,619,466 | 3,117,048 | ||||||

__________________________

(1) Short-term financing receivables, net of allowance for credit losses of RMB102,124 and RMB118,804 as of December 31, 2024 and March 31, 2025, respectively.

Short-term contract assets and receivables, net of allowance for credit losses of RMB409,590 and RMB287,845 as of December 31, 2024 and March 31, 2025, respectively.

Long-term financing receivables, net of allowance for credit losses of RMB1,820 and RMB1,471 as of December 31, 2024 and March 31, 2025, respectively.

Long-term contract assets and receivables, net of allowance for credit losses of RMB30,919 and RMB20,519 as of December 31, 2024 and March 31, 2025, respectively.

| LexinFintech Holdings Ltd. Unaudited Condensed Consolidated Statements of Operations |

|||||||||

| For the Three Months Ended March 31, | |||||||||

| (In thousands, except for share and per share data) | 2024 | 2025 | |||||||

| RMB | RMB | US$ | |||||||

| Operating revenue: | |||||||||

| Credit facilitation service income | 2,648,478 | 2,190,866 | 301,910 | ||||||

| Loan facilitation and servicing fees-credit oriented | 1,417,248 | 1,136,229 | 156,577 | ||||||

| Guarantee income | 744,251 | 547,814 | 75,491 | ||||||

| Financing income | 486,979 | 506,823 | 69,842 | ||||||

| Tech-empowerment service income | 361,543 | 624,850 | 86,107 | ||||||

| Installment e-commerce platform service income | 231,909 | 288,383 | 39,740 | ||||||

| Total operating revenue | 3,241,930 | 3,104,099 | 427,757 | ||||||

| Operating cost | |||||||||

| Cost of sales | (235,747 | ) | (262,032 | ) | (36,109 | ) | |||

| Funding cost | (90,738 | ) | (83,004 | ) | (11,438 | ) | |||

| Processing and servicing cost | (587,731 | ) | (551,141 | ) | (75,949 | ) | |||

| Provision for financing receivables | (136,683 | ) | (182,149 | ) | (25,101 | ) | |||

| Provision for contract assets and receivables | (165,942 | ) | (129,685 | ) | (17,871 | ) | |||

| Provision for contingent guarantee liabilities | (828,377 | ) | (677,180 | ) | (93,318 | ) | |||

| Total operating cost | (2,045,218 | ) | (1,885,191 | ) | (259,786 | ) | |||

| Gross profit | 1,196,712 | 1,218,908 | 167,971 | ||||||

| Operating expenses: | |||||||||

| Sales and marketing expenses | (417,617 | ) | (493,128 | ) | (67,955 | ) | |||

| Research and development expenses | (134,982 | ) | (155,626 | ) | (21,446 | ) | |||

| General and administrative expenses | (89,760 | ) | (100,753 | ) | (13,884 | ) | |||

| Total operating expenses | (642,359 | ) | (749,507 | ) | (103,285 | ) | |||

| Change in fair value of financial guarantee derivatives and loans at fair value | (315,923 | ) | 74,639 | 10,286 | |||||

| Interest expense, net | (3,904 | ) | (4,702 | ) | (648 | ) | |||

| Investment income/(loss) | 90 | (11,699 | ) | (1,612 | ) | ||||

| Others, net | 20,425 | 3,832 | 528 | ||||||

| Income before income tax expense | 255,041 | 531,471 | 73,240 | ||||||

| Income tax expense | (53,418 | ) | (101,147 | ) | (13,938 | ) | |||

| Net income | 201,623 | 430,324 | 59,302 | ||||||

| Net income attributable to ordinary shareholders of the Company | 201,623 | 430,324 | 59,302 | ||||||

| Net income per ordinary share attributable to ordinary shareholders of the Company | |||||||||

| Basic | 0.61 | 1.27 | 0.18 | ||||||

| Diluted | 0.60 | 1.20 | 0.16 | ||||||

| Net income per ADS attributable to ordinary shareholders of the Company | |||||||||

| Basic | 1.22 | 2.55 | 0.35 | ||||||

| Diluted | 1.21 | 2.39 | 0.33 | ||||||

| Weighted average ordinary shares outstanding | |||||||||

| Basic | 330,277,142 | 338,073,723 | 338,073,723 | ||||||

| Diluted | 333,650,104 | 359,646,902 | 359,646,902 | ||||||

| LexinFintech Holdings Ltd. Unaudited Condensed Consolidated Statements of Comprehensive Income | |||||||||

| For the Three Months Ended March 31, | |||||||||

| (In thousands) | 2024 | 2025 | |||||||

| RMB | RMB | US$ | |||||||

| Net income | 201,623 | 430,324 | 59,302 | ||||||

| Other comprehensive income | |||||||||

| Foreign currency translation adjustment, net of nil tax | 2,323 | (2,259 | ) | (311 | ) | ||||

| Total comprehensive income | 203,946 | 428,065 | 58,991 | ||||||

| Total comprehensive income attributable to ordinary shareholders of the Company | 203,946 | 428,065 | 58,991 | ||||||

| LexinFintech Holdings Ltd. Unaudited Reconciliations of GAAP and Non-GAAP Results |

|||||||||

| For the Three Months Ended March 31, | |||||||||

| (In thousands, except for share and per share data) | 2024 | 2025 | |||||||

| RMB | RMB | US$ | |||||||

| Reconciliation of Adjusted net income attributable to ordinary shareholders of the Company to Net income attributable to ordinary shareholders of the Company | |||||||||

| Net income attributable to ordinary shareholders of the Company | 201,623 | 430,324 | 59,302 | ||||||

| Add: Share-based compensation expenses | 23,274 | 29,541 | 4,071 | ||||||

| Interest expense associated with convertible notes | 5,322 | - | - | ||||||

| Investment (income)/loss | (90 | ) | 11,699 | 1,612 | |||||

| Adjusted net income attributable to ordinary shareholders of the Company | 230,129 | 471,564 | 64,985 | ||||||

| Adjusted net income per ordinary share attributable to ordinary shareholders of the Company | |||||||||

| Basic | 0.70 | 1.39 | 0.19 | ||||||

| Diluted | 0.68 | 1.31 | 0.18 | ||||||

| Adjusted net income per ADS attributable to ordinary shareholders of the Company | |||||||||

| Basic | 1.39 | 2.79 | 0.38 | ||||||

| Diluted | 1.35 | 2.62 | 0.36 | ||||||

| Weighted average shares used in calculating net income per ordinary share for non-GAAP EPS | |||||||||

| Basic | 330,277,142 | 338,073,723 | 338,073,723 | ||||||

| Diluted | 339,997,043 | 359,646,902 | 359,646,902 | ||||||

| Reconciliations of Non-GAAP EBIT to Net income | |||||||||

| Net income | 201,623 | 430,324 | 59,302 | ||||||

| Add: Income tax expense | 53,418 | 101,147 | 13,938 | ||||||

| Share-based compensation expenses | 23,274 | 29,541 | 4,071 | ||||||

| Interest expense, net | 3,904 | 4,702 | 648 | ||||||

| Investment (income)/loss | (90 | ) | 11,699 | 1,612 | |||||

| Non-GAAP EBIT | 282,129 | 577,413 | 79,571 | ||||||

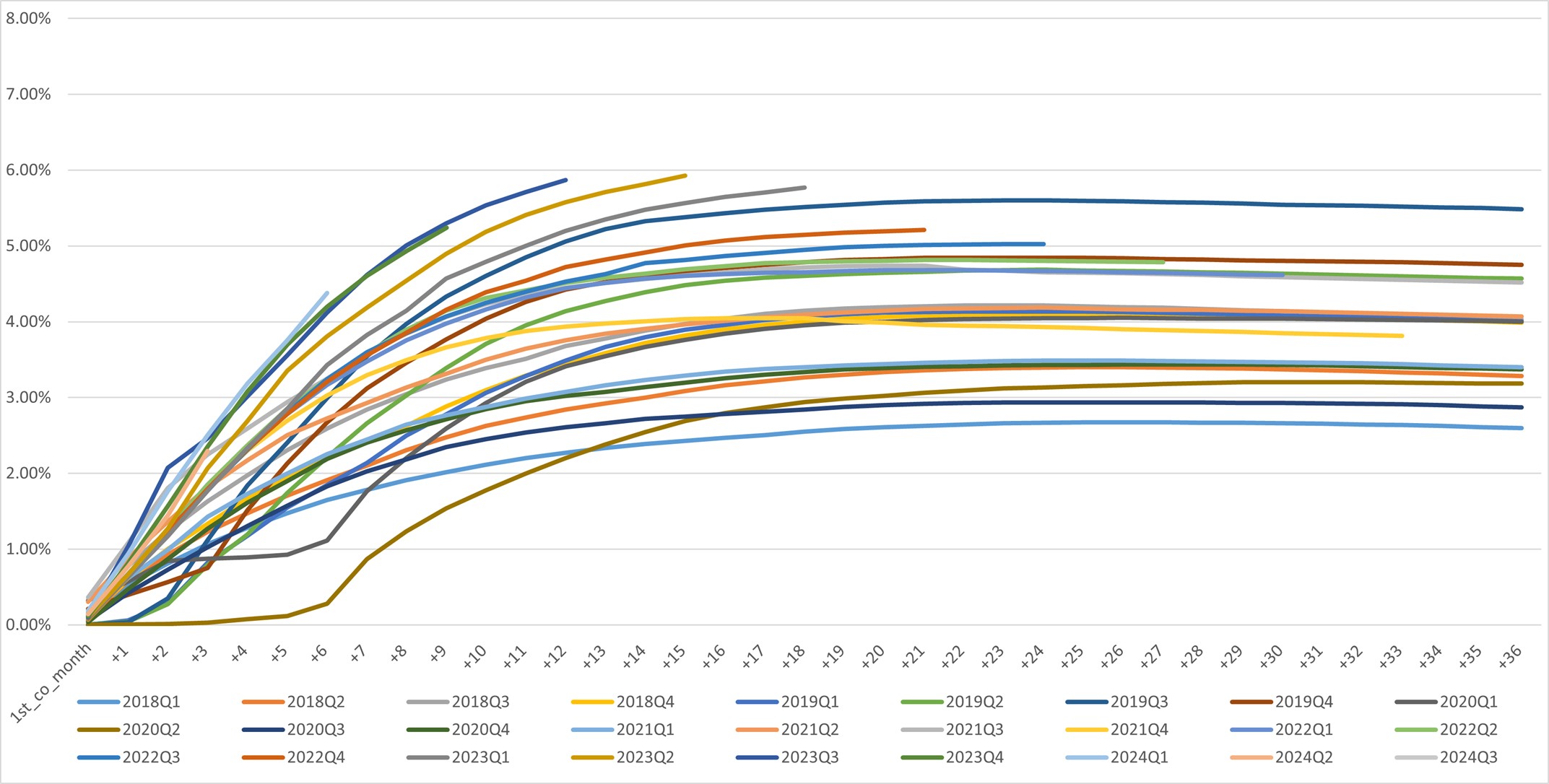

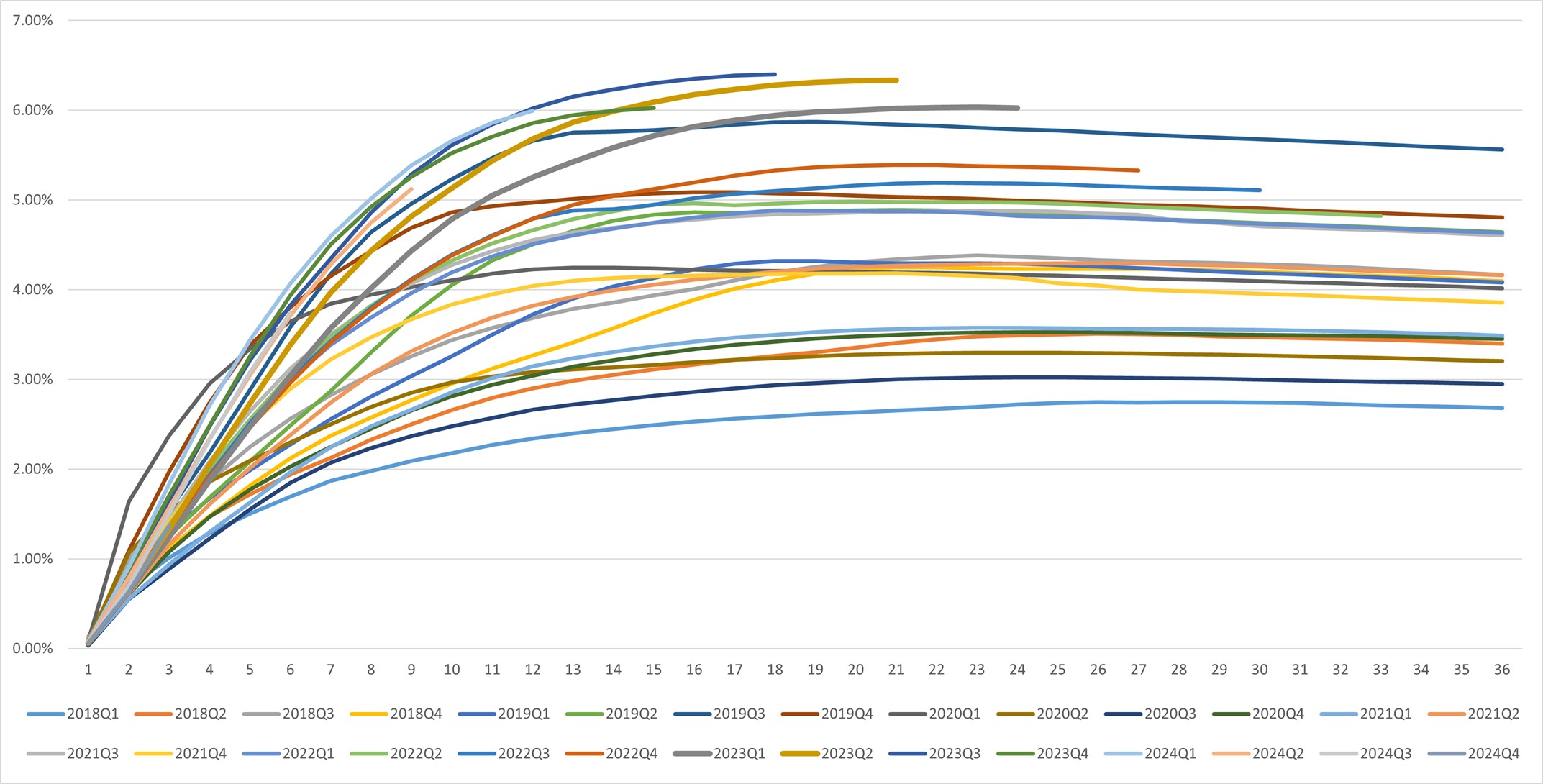

Additional Credit Information

Vintage Charge Off Curve1

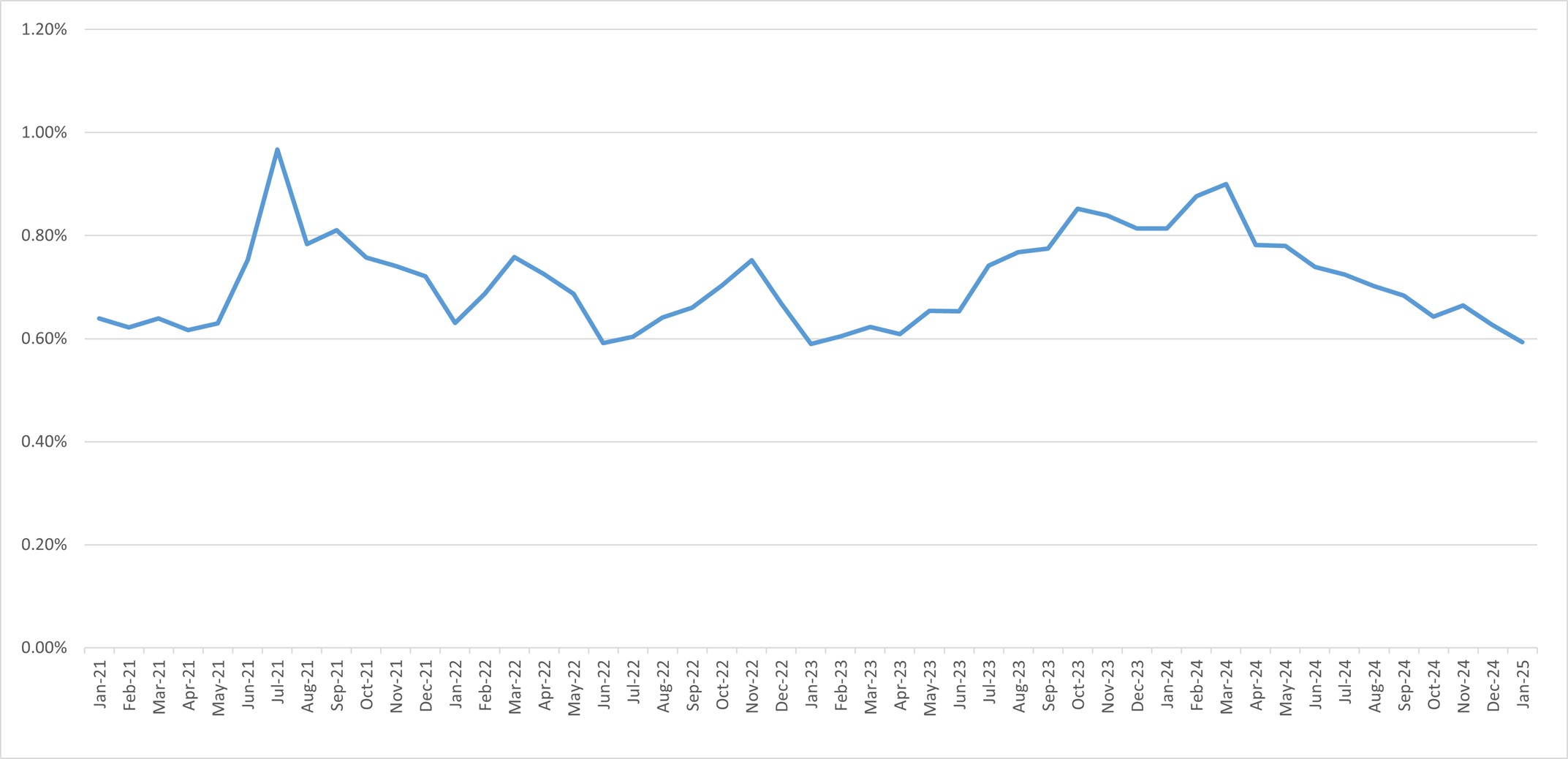

Dpd30+/GMV by Performance Windows1

First Payment Default 30+1

1. Loans facilitated under ICP are excluded from the chart.

Distribution channels: Banking, Finance & Investment Industry, Business & Economy ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release