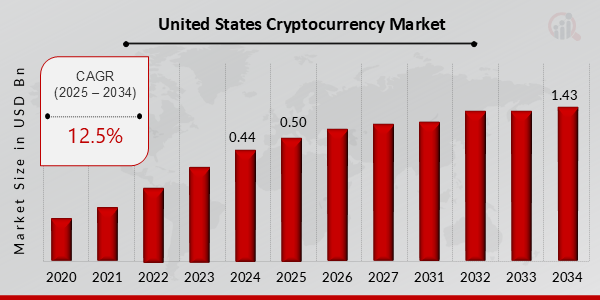

United States Cryptocurrency Market Projected for 12.5% CAGR, Reaching 1.43 Billion by 2032

United States Cryptocurrency Market Growth

United States Cryptocurrency Market Research Report Information By, Component, Hardware, Software, Process, Type, End-Use and Region

FL, UNITED STATES, February 20, 2025 /EINPresswire.com/ -- The United States Cryptocurrency Market has experienced steady growth in recent years and is set for significant expansion over the coming decade. In 2024, the market size was valued at USD 0.44 billion and is projected to grow from USD 0.50 billion in 2025 to an impressive USD 1.43 billion by 2034, reflecting a strong compound annual growth rate (CAGR) of 12.5% during the forecast period (2025–2034). The market's growth is primarily driven by increasing institutional adoption, the rise of decentralized finance (DeFi) applications, and advancements in blockchain technology.

Key Drivers of Market Growth

Rising Institutional Adoption

Major financial institutions, hedge funds, and publicly traded companies are increasingly investing in cryptocurrencies as part of their asset diversification strategies. The approval of Bitcoin exchange-traded funds (ETFs) and regulatory clarity are further accelerating institutional participation.

Growth of Decentralized Finance (DeFi)

The rapid expansion of DeFi applications is revolutionizing the financial landscape by enabling peer-to-peer lending, staking, and yield farming. As DeFi platforms gain popularity, they are driving higher cryptocurrency adoption and liquidity in the market.

Advancements in Blockchain Technology

The evolution of blockchain infrastructure, including Ethereum 2.0 upgrades, Layer 2 scaling solutions, and cross-chain interoperability, is enhancing the efficiency, security, and scalability of cryptocurrency transactions. These advancements are fostering market growth.

Regulatory Developments and Government Policies

The U.S. government and regulatory bodies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are working on clearer frameworks for cryptocurrency regulations. A well-defined legal structure is expected to boost investor confidence and drive market adoption.

Increasing Retail and Merchant Adoption

A growing number of businesses and consumers are using cryptocurrencies for transactions, remittances, and online purchases. Payment processors like PayPal and Visa are integrating crypto payment options, further mainstreaming digital assets.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/21576

Key Companies in the United States Cryptocurrency Market Include

• Advanced Micro Devices, Inc.

• Binance

• Bit fury Group Limited

• Bit Go, Inc.

• Bit Main Technologies Holding Company

• Intel Corporation

• NVIDIA Corporation

• Ripple

• Xapo Holdings Limited

• Xilinx, Inc.

Browse In-depth Market Research Report:

https://www.marketresearchfuture.com/reports/united-states-cryptocurrency-market-21576

Market Segmentation

To provide a comprehensive analysis, the U.S. Cryptocurrency Market is segmented based on type, application, and region.

1. By Type

• Bitcoin (BTC): Dominates the market as the most widely adopted digital asset and store of value.

• Ethereum (ETH): Leading blockchain for smart contracts and DeFi applications.

• Stablecoins: Includes USDT, USDC, and BUSD, providing price stability and liquidity.

• Altcoins: Other cryptocurrencies such as Solana (SOL), Cardano (ADA), and Polkadot (DOT) are gaining traction.

2. By Application

• Investment and Trading: Growing interest from retail and institutional investors in crypto assets.

• Payments and Remittances: Increasing use of cryptocurrencies for cross-border transactions.

• Decentralized Finance (DeFi): Expanding use cases for lending, borrowing, and yield farming.

• Non-Fungible Tokens (NFTs): Digital collectibles and blockchain-based assets driving new revenue streams.

3. By Region

• West Coast: Home to major blockchain startups and tech innovation hubs, including Silicon Valley.

• East Coast: Financial institutions in New York and Washington driving crypto adoption.

• Midwest and South: Increasing interest in crypto mining and blockchain development projects.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=21576

The United States Cryptocurrency Market is on a strong growth trajectory, fueled by institutional investments, DeFi innovations, and technological advancements. As regulatory clarity improves and mainstream adoption increases, the market is expected to witness transformative changes, leading to greater financial inclusion and innovation. With expanding opportunities across different crypto segments, the future of the U.S. cryptocurrency industry looks highly promising.

Related Report –

Crypto Wallet Market

BFSI BPO Service Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release