iPSE-U.S. Association Offers New Health Insurance Bundle to Gig Economy Through Revolt Healthcare Alliance Partnership

The two companies are aligning around an innovative health indemnity plan bundle that provides better, more affordable coverage for independent workers.

While the US Department of Labor protects employees in the traditional employer-based model, very little has been done to reduce risk and to provide protections and equal benefits for the 64 million independent workers across the US. iPSE-U.S. is filling that gap and advocating for fair and equal treatment for all workers.

“I love what iPSE-U.S. is doing and what they stand for.” says Mark Geiger, Co-Founder and Managing Partner of The Revolt Healthcare Alliance. “As an entrepreneur most of my life, I’ve always felt like independent workers got a raw deal on the lack of equality for health insurance benefits available to them and so I couldn’t be happier to support iPSE-U.S. in their effort to provide an equitable benefits solution to independent workers.”

"The opportunity to bring healthcare to the independent workforce has been our goal at iPSE since inception," notes Dr. Carl Camden, founder, and President of iPSE-U.S. As the former CEO of Kelly, a workforce and staffing solutions company, Camden, states, "I realized that access to benefits for this unique workforce was limited, so I founded iPSE-U.S. I’m determined to change the policies and practices that limit their access. To have a viable healthcare offering for independent workers is a vision come true."

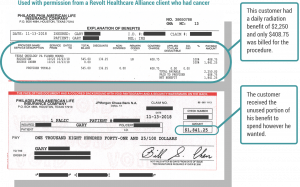

The two companies are aligning around an innovative health indemnity plan bundle that provides better, more affordable coverage than most health insurance plans available on the market. The health indemnity plan bundle offers customers the protection of always having their medical costs paid based on a pre-determined and fixed amount, so customers always know what their plan benefit is before they use it. Customers don’t ever have to pay a deductible either unless they have to stay overnight in the hospital. That means customers can go to the doctor, get labs, x-rays, and receive other out-patient services as soon as they buy the policy. There are also no co-pays or co-insurance.

The health indemnity plan bundle is extremely unique because customers can receive money back when they shop smart for healthcare services. The most popular plan offers a hospital benefit of $3,000 per night. The average cost of an overnight hospital stay is only $2,424. That means customers would receive the left-over benefit of $576 which is called the “excess indemnity.” These excess indemnity checks that customers receive serve as a form of income protection, because when a person is sick many times, they are not able to work. Getting money back from the insurance company helps with that challenge, which is especially valuable to the independent worker, since these are the individuals without paid sick leave.

Revolt Healthcare Alliance's exclusive Concierge service makes using these benefits and navigating the healthcare system a breeze. Concierge membership gives customers access to expert assistance to find in-network providers, file claims, pre-price procedures, and negotiate surprise medical bills advocating for patients by acting as the intermediary between insurance and provider. Concierge service is a separate entity, unbeholden to either the insurance company or provider, which enables them to be an unbiased advocate working exclusively for the patient.

Customers using Concierge have saved an average of $3,664 per case. Without Concierge to help pre-price procedures it's very difficult for consumers to know when a doctor is in-network but the facility is not, or when to ask for the cash-pay price instead of bill through insurance - both are costly, albeit common mistakes that can lead to some very surprising medical bills after the fact. iPSE-U.S.'s independent workers will never be alone in using their benefits because Revolt's Concierge experts are available year-round to offer support and guidance in navigating the often-convoluted healthcare system.

iPSE-U.S. joining the Revolt Healthcare Alliance is about so much more than just offering a superior health insurance plan and protecting their customer’s finances. It’s about joining together in a nationwide alliance with other like-minded businesses to question the status quo of the predatory practices entrenched in the healthcare system and it's about educating people to leverage their consumer spending power to demand better from lawmakers, hospitals, and private insurers.

###

ABOUT REVOLT HEALTHCARE ALLIANCE:

The Revolt Healthcare Alliance offers affordable health insurance through the health indemnity plans and supplementary products underwritten by Philadelphia American Life Insurance, a wholly owned insurance subsidiary of New Era Life Insurance Company. The company is focused specifically on selling their health indemnity plan bundle, as an alternative to major medical Affordable Care Act plans. The company has 306 agents in 34 states serving individuals, families, the self-employed, and small business owners.

ABOUT iPSE-U.S.:

iPSE-U.S., the Association of Independent Workers, honors the millions of Independent Workers, Contractors, Consultants, Freelancers, Self-Employed, Gig Workers, and Small Business Owners in America that choose to structure their work around their lives fearlessly. iPSE-U.S. supports these workers with a political voice, industry insights, portable benefit structure, and an ecosystem of like-minded independent professionals.

Samantha McHone

Revolt Healthcare Alliance, PLLC

+1 469-395-3021

samantha@revolthealthcare.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

TikTok

Affordable Health Insurance: 40%-50% Lower Premiums + Better Benefits And Patient Advocacy Concierge Service

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Consumer Goods, Healthcare & Pharmaceuticals Industry, Insurance Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release