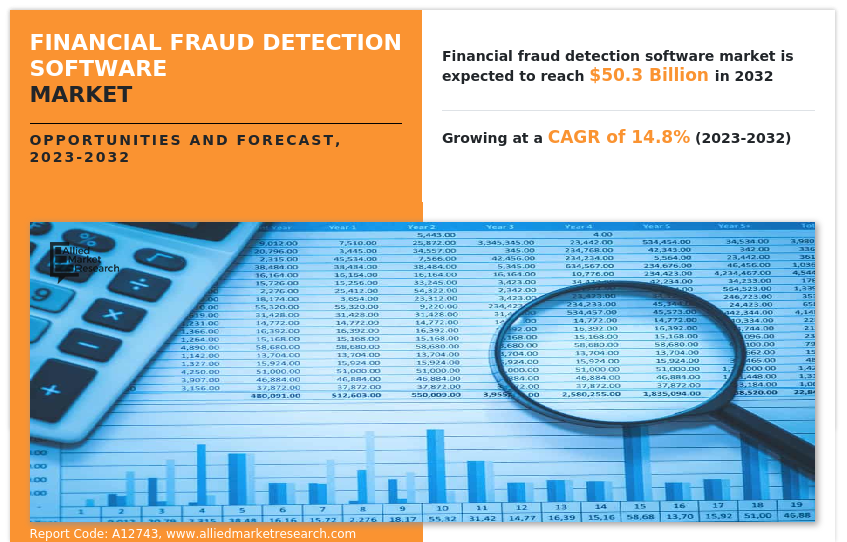

Financial Fraud Detection Software Market Expected to Hit $50,327.02 Million by 2032, Growing at a CAGR of 14.8%

Financial Fraud Detection Software

Financial Fraud Detection Software Market Expected to Hit $50,327.02 Million by 2032, Growing at a CAGR of 14.8%

NEW CASTLE, WILMINGTON, UNITED STATES, April 19, 2024 /EINPresswire.com/ -- Allied Market Research published a report, titled, "Financial Fraud Detection Software Market by Component (Solution and Service), Deployment Mode (On-premise, and Cloud), Fraud type (Money laundering, Identity Theft , Debit & Credit Card Frauds, Claim Frauds , Transfer Frauds , and Others) and End User (Banks, NBFCs, and Others): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report the financial fraud detection software market was valued at $13 billion in 2022 and is estimated to reach $50.3 billion by 2032, exhibiting a CAGR of 14.8% from 2023 to 2032.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A12743

Prime determinants of growth

The growing adoption of online banking applications and mobile banking services and increasing incidences of financial fraud are boosting the growth of the global financial fraud detection software market. in addition, the increase in the use of digital transformation technology positively impacts the growth of the financial fraud detection software market. However, surge in incidents of false positive rates and high implementation costs are hampering the financial fraud detection software market growth. On the contrary, rise in Innovations in the Fintech Industry are expected to offer remunerative opportunities for the expansion of the financial fraud detection software market during the forecast period.

Covid-19 Scenario

The financial fraud detection software market has witnessed stable growth during the COVID-19 pandemic, owing to a rise in demand for anti-money laundering (AML), fraud detection solutions, and various other solutions during the pandemic situation.

Moreover, various public and private entities are expected to come together to create ecosystems to share data for multiple use cases under a common regulatory and cybersecurity framework, which, in turn, is expected to provide lucrative opportunity for the growth of the global market.

The service segment to maintain its leadership status throughout the forecast period.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A12743

Based on component, the service segment held the highest market share in 2022, accounting for more than two-thirds of the global financial fraud detection software market revenue, owing to the rise in incidences of Account Take Overs (ATO) and phishing emails have compelled enterprises to adopt advanced tools and solutions to detect anomaly patterns of fraud at a preliminary stage. However, the service segment is projected to attain the highest CAGR of 16.7% from 2023 to 2032, owing to organizations in developing economies which are increasingly implementing robust fraud prevention strategies.

The banks segment to maintain its leadership status throughout the forecast period

Based on end user, the banks segment held the highest market share in 2022, accounting for nearly two-fifths of the global financial fraud detection software market revenue, owing to increase in demand for personalization and self-service on services and products. However, the NBFCs segment is projected to attain the highest CAGR of 17.0% from 2023 to 2032, owing to increase in demand for personalization and self-service and products.

Asia-Pacific maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global financial fraud detection software market revenue, owing to rise in adoption of financial fraud detection software in small & medium enterprises to ensure effective flow of financial activities. However, the Asia-Pacific region is expected to witness the fastest CAGR of 18.0% from 2023 to 2032 and is likely to dominate the market during the forecast period, due to the growing adoption of web-based and mobile-based business applications in the sector of banking.

Leading Market Players: -

Feedzai,

FiCO,

Oracle Corporation,

ThreatMetrix,

SAS Institute Inc.,

SAP SE,

Fiserv, Inc.,

IBM Corporation,

Software AG,

Experian plc.,

The report provides a detailed analysis of these key players of the global financial fraud detection software market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A12743

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial fraud detection software market analysis from 2023 to 2032 to identify the prevailing financial fraud detection software market opportunity.

The financial fraud detection software market outlook research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the financial fraud detection software market segmentation assists to determine the prevailing market .

Major countries in each region are mapped according to their revenue contribution to the global financial fraud detection software market forecast.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the financial fraud detection software market players.

The report includes the analysis of the regional as well as global financial fraud detection software market trends, key players, market segments, application areas, and financial fraud detection software market growth strategies.

Financial Fraud Detection Software Market Report Highlights

Aspects Details

By Component

Solution

Service

By Deployment Mode

On-premise

Cloud

By Fraud Type

Money Laundering

Identity Theft

Debit and Credit Card Frauds

Claim Frauds

Transfer Frauds

Others

By End User

Banks

NBFCs

Others

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/8be60ad29a4baff313b3745b38f4632d?utm_source=AMR&utm_medium=research&utm_campaign=P19623

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

➡️𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 :

Decentralized Finance Market

https://www.alliedmarketresearch.com/decentralized-finance-market-A200418

E-commerce Market

https://www.alliedmarketresearch.com/e-commerce-market-A107885

Surety Market

https://www.alliedmarketresearch.com/surety-market-A31385

Reinsurance Market

https://www.alliedmarketresearch.com/reinsurance-market-A06288

Management Consulting Services Market

https://www.alliedmarketresearch.com/management-consulting-services-market-A19875

Medical Professional Liability Insurance Market

https://www.alliedmarketresearch.com/medical-professional-liability-insurance-market-A30183

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

David Correa

Allied Market Research

+ +1 5038946022

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.